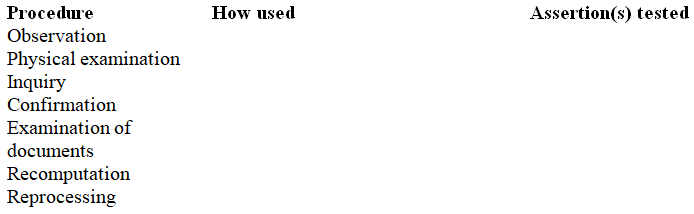

Audit procedures.

Discuss how each of the following procedures could be used in the audit of fixed assets, e.g., various types of equipment used in the business.

Definitions:

Profit Center

A subunit of the firm with the decision rights over prices and manufacturing processes to maximize profit. Profit centers are evaluated on meeting target profits and are composed of several cost centers.

Responsibility Centers

Units or departments within an organization whose managers are accountable for specific financial operations and performance.

Decision Rights

The duties that a particular individual in an organization is expected to perform.

Performance Evaluation

This involves assessing an employee's job performance using various criteria to determine the effectiveness and efficiency of their work.

Q3: According to Aronson, the primary appeal of

Q4: Much of the understanding of revenue transactions

Q42: Audit procedures have to be announced or

Q44: Homer and Moe,PC are auditing the financial

Q56: Which of following is not required by

Q58: An individual does not need to agree

Q65: Forensic accountants need to have excellent interviewing

Q72: The results of MUS sampling will be

Q85: When performing attribute sampling,which of the following

Q112: Sales transactions should be documented at initiation