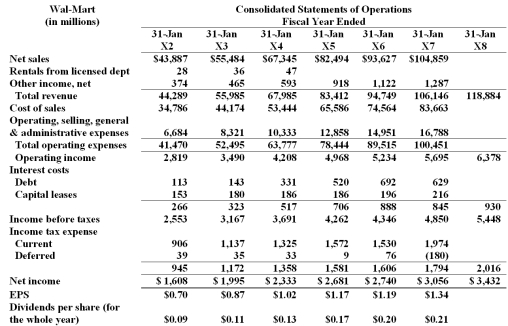

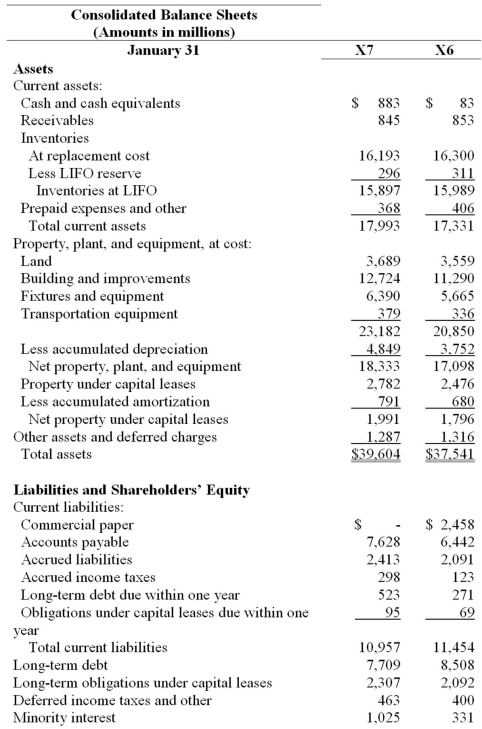

Refer to Wal-Mart's financial statements, below.

Shareholders' Equity

Shareholders' Equity

Preferred stock ( par value; 100 share authorized. none issued)

Common stock ( par value; 5.500 million shares authorized. 2,285 million and 2,293 million issued and

a. Calculate: total debt to equity ratio and times interest earned ratio for fiscal X6 and X7. Comment on your results.

b. Analysis of Wal-Mart's footnotes reveals the existence of significant operating leases. Explain whether this would change your answer in part a) and how you would make the changes.

Definitions:

Actual Output

The real quantity of goods or services produced by a company, as opposed to planned or expected output.

Standard Variable Overhead Rate

The rate used in budgeting and costing that applies variable overheads to a specific activity basis such as labor hours.

Direct Labour Hours

The aggregate hours employees devoted to the process of production have logged.

Variable Overhead

Costs that vary with the level of output, such as utilities and labor, as opposed to fixed overheads.

Q2: The intrinsic value approach ignores two types

Q8: Employee stock options (ESOs) usually constitute a

Q15: Why is auditing important in a free

Q27: It is simple for auditors to test

Q40: The earnings to fixed charges ratio:<br>A)indicates how

Q44: Under U.S. GAAP, the method used to

Q51: The acquisition process begins with a purchase

Q52: If an expense is recognized for financial

Q57: Limited physical access to long-lived assets is

Q93: Which of the following is not likely