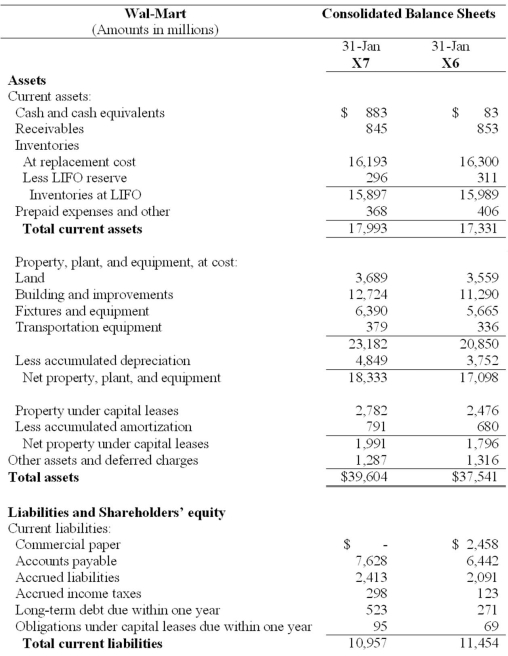

Shareholders' Equity:

Preferred Stock Par Value; 100 Shares Authorized, None Issued)

Common Stock

Shareholders' equity:

Preferred stock ( par value; 100 shares authorized, none issued)

Common stock ( par value; 5,500 shares authorized, 2,285 and

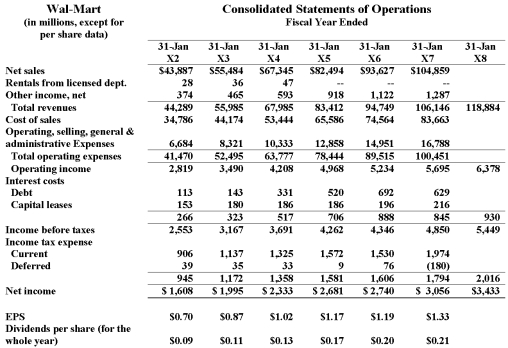

a. Calculate return on common equity (ROCE) for fiscal X4 and X7. Identify, as far as allowed by the data, components driving any changes in ROCE from X4 to X7. (If you want to give students more guidance then ask to disaggregate ROCE into net operating profit margin, net operating asset turnover and leverage.)

b. Compare and contrast the change in earnings per share to ROCE over this time period.

Definitions:

Probable

Likely to occur or be the case.

Optimistic

Having a positive outlook or expectation about the future or the success of something.

AOA Networks

Activity on Arrow networks, a type of diagram used in project management to represent tasks and their dependencies.

AON Networks

A telecom company known for providing various networking solutions, including internet services, unless pertaining to specific technology or acronym meanings not widely recognized.

Q1: Gains and losses from the sale of

Q6: Assume Xena uses the current rate method

Q14: While screening hundreds of companies for investment

Q16: The matching principle in accounting prescribes that

Q54: Types of Controls Identify the types of

Q57: What is net cash flow from investing?<br>A)$10,000<br>B)$5,000<br>C)($5,000)<br>D)($15,000)

Q59: Which of the following is correct?<br><br>I. If

Q62: Which organization issued the Internal Control,Integrated Framework

Q73: If a company wishes to increase its

Q82: A firm has net sales of $6,000,