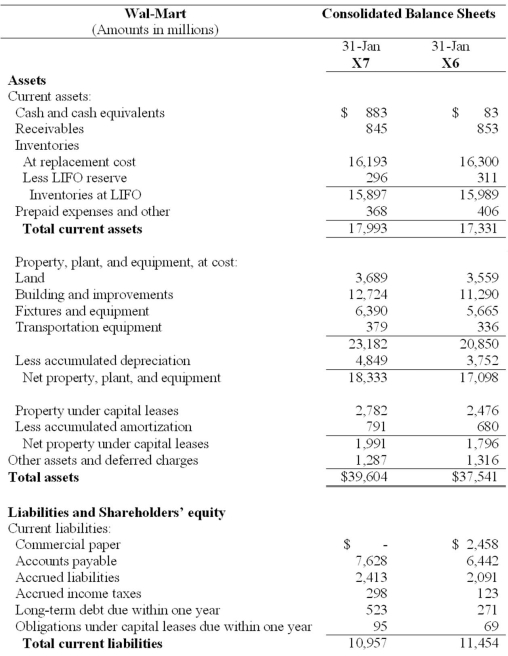

Shareholders' Equity:

Preferred Stock Par Value; 100 Shares Authorized, None Issued)

Common Stock

Shareholders' equity:

Preferred stock ( par value; 100 shares authorized, none issued)

Common stock ( par value; 5,500 shares authorized, 2,285 and

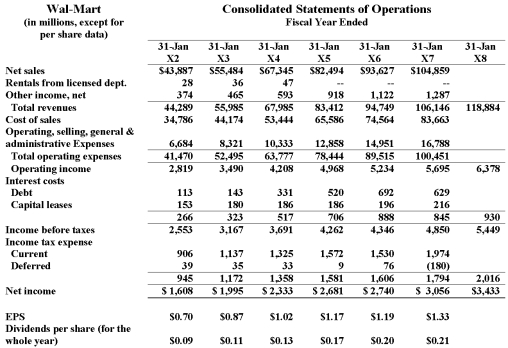

a. Calculate return on common equity (ROCE) for fiscal X4 and X7. Identify, as far as allowed by the data, components driving any changes in ROCE from X4 to X7. (If you want to give students more guidance then ask to disaggregate ROCE into net operating profit margin, net operating asset turnover and leverage.)

b. Compare and contrast the change in earnings per share to ROCE over this time period.

Definitions:

Vertical Axis

In graph theory and visuals, the vertical axis is typically the y-axis, representing dependent variables or metrics that can be measured against the independent variables on the horizontal axis.

Price Elasticity of Demand

A measure of how much the quantity demanded of a good responds to a change in the price of that good, quantitatively defined as the percentage change in quantity demanded divided by the percentage change in price.

Equilibrium Values

The set of prices or quantities at which markets or economies reach a balance between supply and demand.

Intercept Coefficient

The value of the dependent variable when all independent variables in a regression model are equal to zero.

Q9: An increase in accounts receivable does not

Q16: What were the cash proceeds from the

Q17: For item to be considered extraordinary, it

Q26: In determining long-term future cash flows, it

Q42: Beginning accounts receivable are $76,000. Sales for

Q53: Internal controls are the responsibility of management.

Q63: Under current US GAAP, goodwill is:<br><br>I. amortized

Q68: Return on assets for Company A

Q70: Which of the following would require an

Q90: According to the Financial Reporting Council (FRC),when