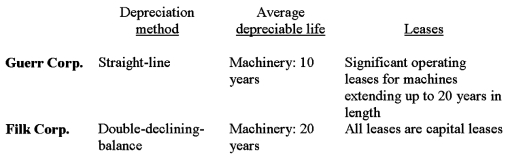

You are analyzing two companies that operate in the same industry. They are both growing capital-intensive manufacturing companies, Guerr Corp. and Filk Corp. A diligent reading of their annual reports reveals the following:

You know that these accounting differences will affect the comparability of the two company's financial results.

Consider each of the above items (depreciation method, average depreciable lives and leases) separately and determine all other things being equal, whether the following ratios will be higher, lower or the same for Guerr when compared to Filk. Explain your answers.

i. Observed price-to-earning ratio in the initial years

ii. Price-to-free cash flow in the initial years

iii. Price-to-book value in the initial years

Definitions:

Drawer's Account

In financial terms, the account belonging to the person who writes a check or draft instructing a bank to pay a designated amount of money.

Honor The Check

The act of a bank or financial institution completing the transaction by paying the amount specified on a check from the payer's account to the payee or holder.

Account Aggregation

A financial service that compiles information from various accounts, belonging to an individual or entity, into a single platform for easier management and analysis.

Financial Management

The strategic planning, organizing, directing, and controlling of financial undertakings in an organization or an institution; it also includes applying management principles to the financial assets of an organization.

Q5: Which of the following would be considered

Q8: What technique is used when patients are

Q15: If a company is to successfully remain

Q24: The cash reinvestment ratio is a measure

Q30: When calculating Acme's return on net operating

Q31: The following information was obtained from

Q34: Which of the following would be considered

Q54: Cash flow from operations is usually less

Q69: When calculating return on total equity, it

Q96: Which of the following approaches is based