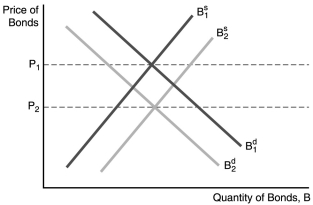

-In the figure above,the price of bonds would fall from P1 to P2 when

Definitions:

Cash Flow

The net amount of cash and cash-equivalents being transferred into and out of a business, indicating the organization's liquidity.

Bond Principal

Bond principal, or face value, is the amount that the issuer agrees to pay the bondholder at maturity, excluding any interest payments.

Coupon Rate

The interest rate on a bond, determined as a percentage of the bond's face value, that the issuer promises to pay the bondholder annually.

Market Rate

The current price or interest rate at which an asset or service can be bought or sold in a particular market.

Q10: Equity contracts<br>A)are claims to a share in

Q27: An animal model is a disease in

Q38: Although restrictive covenants can potentially reduce moral

Q40: Everything else held constant,a decrease in marginal

Q46: A possible sequence for the three stages

Q47: If the price level increases,everything else held

Q53: An increase in the money _ shifts

Q54: The yield to maturity for a one-year

Q77: Which nutrient is an inorganic substance?<br>A)vitamin A<br>B)zinc<br>C)protein<br>D)thiamin

Q115: In the figure above,the decrease in the