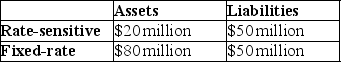

Use the following table to answer the question :

-Assuming that the average duration of its assets is five years,while the average duration of its liabilities is three years,then a 5 percentage point increase in interest rates will cause the net worth of First National to decline by ________ of the total original asset value.

Definitions:

Buying Power

The amount of goods or services that can be purchased with a unit of currency.

Flexible Exchange Rates

A currency system where the price of a country's currency is set by the forex market based on supply and demand relative to other currencies.

Macroeconomic Instability

Occurs when an economy experiences high levels of volatility in factors such as inflation, growth rates, and unemployment, often leading to economic downturns.

Comparative Advantage

The ability of an entity to produce a good or service at a lower opportunity cost than others, promoting trading benefits.

Q4: The existence of deposit insurance can increase

Q13: Which of the following statements most accurately

Q40: As in the United States,an important factor

Q66: Since depositors,like any lender,only receive fixed payments

Q75: Critics of nationwide banking fear<br>A)an elimination of

Q77: The organization responsible for the conduct of

Q94: The interest rate on Baa (medium quality)corporate

Q99: Sustained downward movements in the business cycle

Q126: Which of the following are reported as

Q128: When a $10 check written on the