First Bank recognized an extraordinary loss from the settlement of a lawsuit with Fifth Street Bank that it had impeded on a processing patent. The extraordinary loss was in the amount of $3,250,000 and First Bank Corporation has an effective tax rate of 35%. First Bank paid the settlement immediately and recognized the tax benefit as a receivable to offset the current period's taxes.

Instructions:

a. Prepare the extraordinary it em poition of First Bank Corporationstinancal statement.

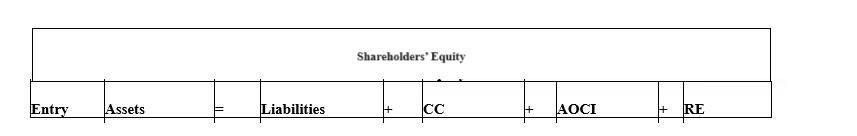

b. Using the analytical framework discussed in the text and reprinted below show the effect of following event on First Bank Corporation's

Analytical Framework:

Definitions:

Dishonored Note

A promissory note that has not been paid by the maker at maturity, resulting in a default.

Collection Efforts

Activities undertaken by a business or organization to pursue and receive payments owed by customers or clients.

Reversing Entries

Journal entries usually made at the beginning of an accounting period to reverse or cancel out adjusting entries from the end of the previous period.

Allowance Method

An accounting technique used to anticipate and adjust for potential future losses from uncollectible accounts receivable.

Q1: The statutory tax rate differs from a

Q1: _ represents the concept of being able

Q9: Match the following terms with their definition.<br>I.Database<br>II.Information<br>III.Data<br>IV.DBMS<br>V.Transaction-based

Q12: Gains and losses that appear in Other

Q34: The _ number format displays at least

Q46: Traditionally,files have been saved locally on a

Q70: Which of the following calculations is used

Q70: The beta coefficient measures the _ of

Q80: A(n)_ key is created from naturally occurring

Q81: When you use Office 2013 on a