Parnell Industries

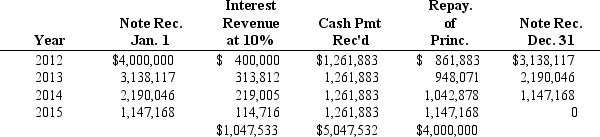

Parnell Industries sold a copy machine to Ranger Inc. on January 1, 2012. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Parnell to manufacture. Ranger will make four payments at the end of each year, beginning with 2012, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below:

-If Parnell Industries is uncertain that it will collect all four payments from Ranger Inc.and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Parnell recognize in 2012 from the sale?

Definitions:

Implicit Group Metafavoritism

The unconscious bias towards favoring one's own group, influencing group dynamics and perceptions.

Prototype

An initial model or early sample of a product used to test and refine the concept or design before final production and release.

Central Tendencies

Statistical measures that summarize the center or typical value of a dataset, including mean, median, and mode.

Cultural Variations

Differences in the practices, traditions, and norms observed among various cultures.

Q7: A(n)_ is when the field only depends

Q19: Sensitron and Douglas Tools manufacture and

Q28: Firms with simple capital structures can have

Q34: When calculating the quick ratio, an analyst

Q46: If a firm is growing and expanding

Q60: <br><br> Using the information provided by Santa

Q62: When firms use derivatives effectively to manage

Q71: A(n)_ defines a consistent template and provides

Q72: A _ provides an easy-to-read format suitable

Q86: Gorilla, Corp. implemented a defined-benefit pension