Magnum Construction contracted to construct a factory building for $545,000. The company started during 2012 and was completed in 2013. Information relating to the contract is as follows:

Costs incurred during the year Estimated additional cost to complete Billings during the year Cash collections during the year 2012$310,000165,000280,000260,0002013$170,000−285,000305,000

Required:

Record the preceding transactions in Magnum's books under completed-contract and the percentage of completion methods. Determine amounts that will be reported on the balance sheet at the end of 2012.

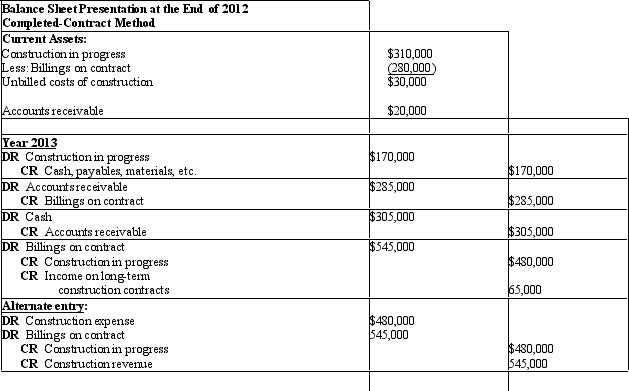

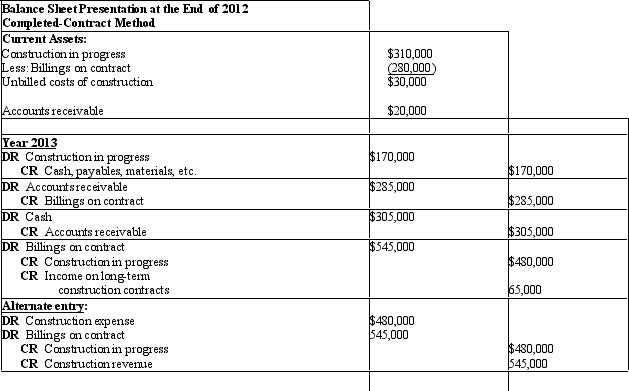

Conpleted-Contract Method Year 2012 DR Construction in progress CR Cash, payables, materials, etc. DR Accounts receivable CR Billings on contract DR Cash CR Accountsreceivable Since the project is incomplete, no revenue is recogrized for the year 2012$310,000$280,000$280,000$260,000$310,000$260,000

Percentige-of-Conpletion Method Year 2012 DR Construction in progress CR Cash, payables, materials, etc. DR Accounts receivable CR Billings on contract DR Cash CR Accountsreceivable$310,000$280,000$260,000$310,000$280,000$260,000

Percentige-of-Conpletion Method Year 2012 DR Construction in progress CR Cash, payables, materials, etc. DR Accounts receivable CR Billings on contract DR Cash CR Accountsreceivable$310,000$280,000$260,000$310,000$280,000$260,000

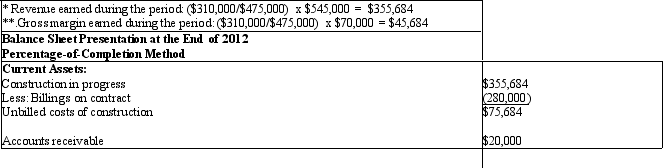

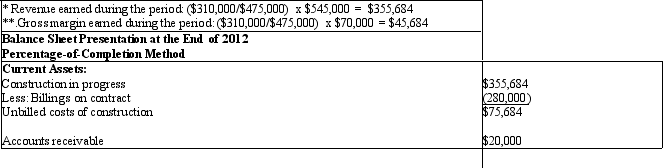

DR Construction in progress’ CR Income onlong-term construction contractsAlteminte entry: DR Construction in progress DR Construction expense CR Construction revenue* "Contract price - Actual coststo date - Estimated costs to complete Total estimated costs of project Estimated total grossmargin $45,684$45,684310,000($310,000)(165,000)$45,684$355,684$545,000(475,00)$70,000

Definitions:

Coping Strategy

Methods or techniques used by individuals to handle stress, manage problems, or adjust to psychological distress.

Reappraising

The cognitive process of changing one's emotional response to a situation by altering one's interpretation of that situation.

Inauthentic Expression

A display of emotions or feelings that does not genuinely reflect what one is actually experiencing.

Authentic Emotions

Genuine feelings that are experienced and expressed congruently with one's true emotional state.