Selected risk ratios are presented for 2011 and 2010 for Techtron Company. Also, refer to the financial statement data for the company.

Revenues to Cash RatioDays Revenues Held in CashCurent RatioQuick RatioOperating Cash Flow to Average Current Liabilities RatioDays Accounts ReceivableDays InventoryDays Accounts P ayableNet Days Working C apitalLiabilities to Assets RatioLiabilities to Shareholders’ Equity RatioLong Term Debt to Long Term Capital RatioLong Term Debt to Shareholders’ Equity RatioOperating C ash Flow to Total Liabilities RatioInterest Coverage Ratio20115.8541.51.147.3%585147720.5591.2660.3300.4920.2435.620107.7471.51.155.7%736849910.6211.6390.4180.7200.2422.3

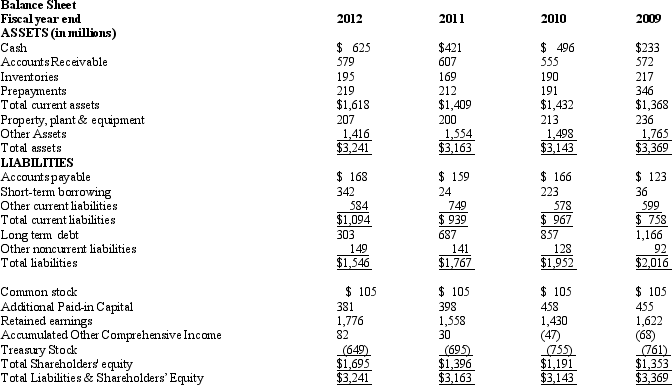

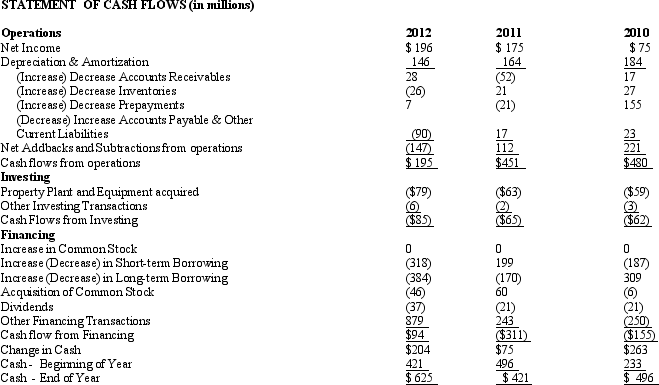

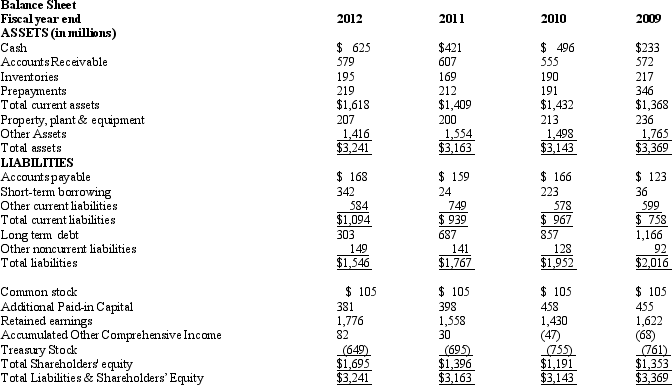

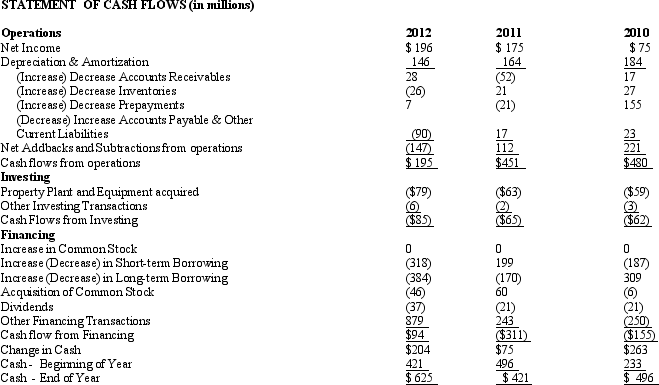

Financial Statements

INCOML STATEMLNT (in IHbILS)

Fiscal year endSalesCost of Goods SoldSelling, General & Admin. Exp.AdvertisingResearch and DevelopmentRoyalty ExpenseOther Selling and AdmiristrativeInterest expenseIncome tax expenseNet income2012$2,500(1,252)(387)(157)(223)(385)(32)(64)$1962011$3,139(1,288)(364)(143)(248)(799)(53)(69)$1752010$2,816(1,099)(297)(154)(290)(788)(78)(29)$75

Required:

Required:

a. Calculate the amounts of these ratios for 2012.

b. Assess the changes in the short-term liquidity risk of Techtron between 2010 and

2012 and the level of that risk at the end of 2012.

c. Assess the changes in the long-term solvency risk of Techtron between 2010 and

2012 and the level of that risk at the end of 2012.

Definitions:

Ocular Lens

The lens within a microscope or camera that is closest to the eye when someone looks through the device.

Objective Lens

The lens in a microscope that is closest to the specimen, magnifying the image.

Mechanical Stage Control

A feature on microscopes that allows for precise movement of the specimen slide in the horizontal plane, facilitating detailed examination.

Fine Adjustment Knob

A part of a microscope used to make small adjustments in focus, enhancing the clarity of the image.

Required:

Required: