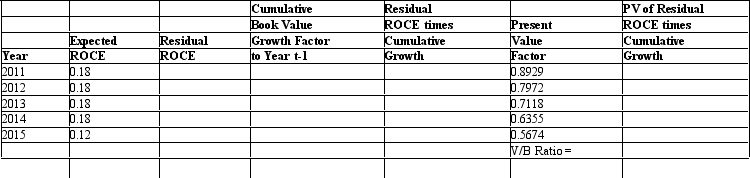

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 12 percent. Assume that the analyst forecasts that the firm will earn ROCE of 18 percent until year 2015, when the firm will start earning ROCE equal to 12 percent. The company pays no dividends and will not engage in any stock transactions. Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Functional Magnetic Resonance Imaging

A neuroimaging technique that measures brain activity by detecting changes associated with blood flow, used to observe brain structures and determine areas of activity during certain tasks.

Brain Function

Encompasses the activities and processes that the brain performs to support physical coordination, intellectual capabilities, and emotional and psychological well-being.

Glucose

A basic form of sugar that serves as a crucial source of energy for living beings and is found in numerous carbohydrate structures.

Electroencephalograph

An instrument used to record the electrical activity of the brain, typically via electrodes placed on the scalp.

Q3: The _ is/was an attempt by European

Q11: What level are inputs for estimating fair

Q15: Discuss how firms should account for intangible

Q17: Glad Rags, Inc. sells women's clothes.

Q21: Below is financial information for two

Q31: <br> Refer to the information for

Q35: If a firm generates a rate of

Q41: The return on assets measures operating performance

Q44: If a portfolio manager had to estimate

Q65: A set of economic policy tools designed