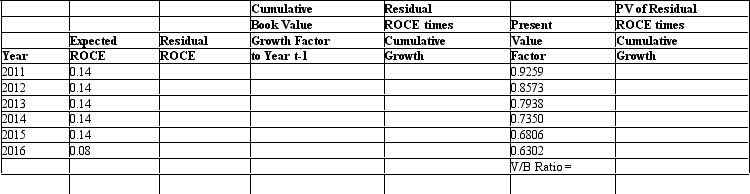

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 8 percent. Assume that the analyst forecasts that the firm will earn ROCE of 14 percent until year 2016, when the firm will start earning ROCE equal to 8 percent. The company pays no dividends and will not engage in any stock transactions. Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Repression

The psychological defense mechanism of unconsciously blocking unpleasant feelings, desires, or experiences from awareness.

Reconsolidation

The neural process involved when memories are recalled and then stored again for retrieval, which may lead to changes or alterations in the original memory.

Previously Stored Memories

Memories that have been encoded and stored in the brain from past experiences.

Online Banking Password

A secure string of characters used to authenticate and gain access to an individual's bank account over the internet, ensuring the privacy and protection of financial information.

Q4: In the wake of the September 11

Q8: Below is information from the statement of

Q20: <br> Assuming that Santa Corporation was required

Q28: Firms with simple capital structures can have

Q28: The payment of dividends would be classified

Q29: Free cash flows for common equity shareholders

Q33: Firms with low P/E ratios tend to

Q47: Nichols and Wahlen's 2004 study showed that

Q58: Shady Sunglasses operates retail sunglass kiosks

Q75: _ financial statements are helpful in highlighting