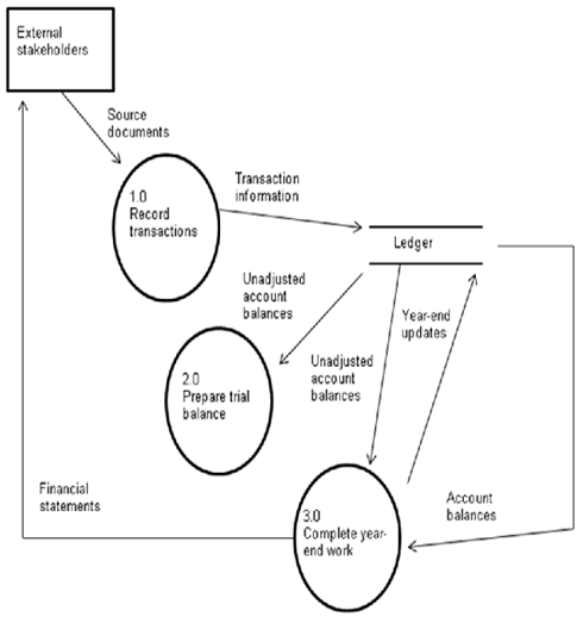

Please refer to the data flow diagram below in answering the next question:  Which of the following statements about the data flow diagram is most true?

Which of the following statements about the data flow diagram is most true?

Definitions:

Income Tax Expense

This is the amount of expense that a company recognizes in its financial statements for the income tax due on its taxable income.

Current Tax Liability

The amount of income taxes a company is obligated to pay within the next year.

Accounting Standards

Authoritative standards and principles that guide financial accounting and reporting practices for businesses and organizations.

Deferred Tax Item

An accounting concept representing a future tax liability or asset, resulting from temporary differences between the carrying amount of an asset or liability in the balance sheet and its tax base.

Q15: AIS is an important area of study

Q19: Which of the following exemplifies "materiality" as

Q27: All of the following would be used

Q28: Booksellers of Bufluffia is a small, independent

Q35: One of the steps in the generalized

Q52: Describe your personal strategy for making decisions

Q52: Homemade Crafts Company (HCC) sells collectible items

Q55: According to expectancy theory, motivation is determined

Q82: An obligation that arises from an existing

Q85: On January 1, 2012, Investor Corporation