Max's Tire Center Company

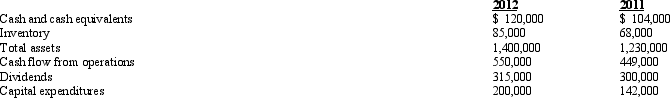

Selected data from the financial statements of Max's Tire Center are provided below.

- Refer to the selected data provided for Max's Tire Center. Which of the following would result from a vertical analysis of Max's cash and cash equivalent in 2012?

Definitions:

IRRs

Internal Rate of Return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments, calculated as the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

NPVs

Net Present Values; the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Capital Budgeting

The process of evaluating and selecting long-term investments that are in line with the goal of a company’s wealth maximization.

Average Accounting Return

A measure of an investment's profitability, calculated as the average net income divided by the average investment.

Q19: What is the matching principle? How does

Q23: Stricker Company sold equipment for $4,000. This

Q25: Which internal control activity is violated when

Q46: AIS is an important area of study

Q49: Amethyst Company paid off a $100,000 two-year

Q51: Richy Automotive uses the periodic inventory system.

Q66: In _ analysis, each financial statement line

Q71: Refer to the selected data provided

Q78: Butler Corporation uses plant assets that are

Q85: Fisher Apartments purchased an apartment building to