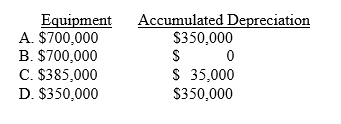

Sharp Inc. purchased equipment at a cost of $700,000 in January, 2003. As of January 1, 2012, depreciation of $315,000 had been recorded on this asset. Depreciation expense for 2012 is $35,000. After the adjustments are recorded and posted at December 31, 2013, what are the balances of Equipment and Accumulated Depreciation?

Definitions:

Walter Freeman

A controversial American physician known for his role in popularizing the lobotomy procedure.

Egas Moniz

A Portuguese neurologist and the developer of cerebral angiography, also awarded the Nobel Prize for pioneering the prefrontal leucotomy procedure.

Transorbital Lobotomy

A form of lobotomy introduced in the 1940s that involves severing connections in the brain's prefrontal lobe, through the eye sockets, to treat mental illnesses.

Brain Tissue

The soft, complex substance that makes up the brain, comprising neurons and supportive cells.

Q5: The amount of inventory expensed during the

Q6: The understatement of ending inventories in one

Q14: <br>Refer to the information provided for Tyson

Q38: Arnold, Inc. purchased a truck on January

Q46: Refer to the information provided for

Q58: The financial statement that summarizes the operating,

Q75: Which of the following is not included

Q81: Transportation-in is:<br>A) an operating expense.<br>B) part of

Q88: Delry Appliances<br>On August 1, 2012, Delry Appliances

Q92: The order of presentation of activities on