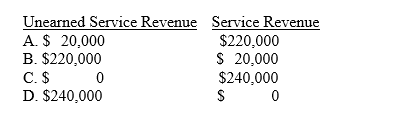

Timberland Company received advance payments from customers during 2012 of $240,000. At December 31, 2012, $20,000 of the advance payments still had not been earned. After the adjustments are recorded and posted at December 31, 2012, what will the balances be in the Unearned Service Revenue and Service Revenue accounts?

Definitions:

Share Certificate

A physical document issued by a company that certifies ownership of a specific number of shares or stock in that company.

Shareholder

An individual or entity that owns shares in a corporation, holding a portion of the company's stock and potentially influencing its governance.

Model Nonprofit Corporation Act

A standardized legislative framework designed to provide guidelines for the formation, operation, and governance of nonprofit organizations.

Nonprofit Corporation

An organization that operates for a charitable, educational, cultural, or social purpose rather than for profit.

Q20: Which one of the following is the

Q24: Classify the following items according to the

Q25: Kellson, Inc.<br>Selected data from the financial statements

Q57: Below are selected financial data for Bouquet,

Q57: The initials GAAP stand for:<br>A) General Acceptance

Q59: Baxter Tile, Inc. purchased new trucks at

Q64: Under the _ method of amortization, an

Q88: When a firm borrows money, one effect

Q93: If a company uses the direct write-off

Q96: Refer to the information provided for IPOD