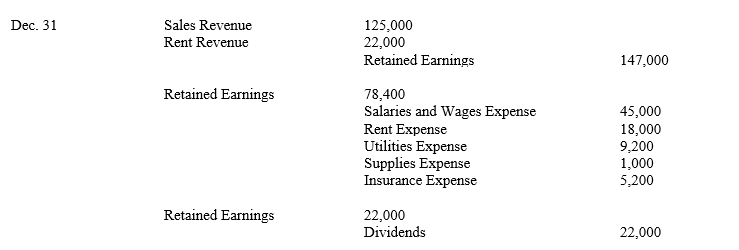

Big Dog Company began operations on January 1, 2012. The accountant for Big Dog has recorded the closing entries in the general journal at the company's year-end, December 31, 2012. In addition, the closing entries have been created in the computerized general ledger and the computer has generated a year-end trial balance. Since the closing entries have already been posted, the income statement that the computer printed has the proper account names, but all accounts have zero balances. In addition, the statement of retained earnings shows net income and dividends equal to zero instead of the correct 2012 net income and dividends. As you examine the general journal, you find the closing entries below:

In good form, prepare a statement of retained earnings for the year ended December 31, 2012. The beginning balance of retained earnings is zero.

In good form, prepare a statement of retained earnings for the year ended December 31, 2012. The beginning balance of retained earnings is zero.

Definitions:

Q17: Which of the following results is generally

Q36: Leno, Inc. <br>Data for Leno, Inc. for

Q39: Issued shares represent the:<br>A) number of previously

Q50: Harper Company lends Hewell Company $40,000 on

Q57: If the sum of the debits is

Q63: Peck Tech. purchased a patent at the

Q63: Under accrual basis of accounting, expenses are

Q66: The financial statements are prepared immediately after:<br>A)

Q79: <br>When using the indirect method, where is

Q83: Cash flows from acquiring and disposing of