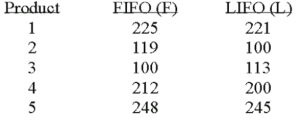

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) .A manufacturer evaluated its finished goods inventory (in $ thousands) for five products both ways.Based on the following results,is LIFO more effective in keeping the value of his inventory lower?  What is the null hypothesis?

What is the null hypothesis?

Definitions:

Audits

Examination and evaluation of an organization's or individual's financial records to ensure accuracy and compliance with laws and regulations.

Designated Beneficiary

An individual or entity chosen to receive benefits or assets upon the death of the policyholder or account holder.

Right to Change

The authority to alter or modify something, often found in contractual agreements or policies.

First-in-time Rule

A principle that establishes priority in various legal contexts, generally indicating that the first in time in taking certain actions has superior rights.

Q1: What is the proportion of explained variation

Q42: A bank wishes to estimate the mean

Q44: What is the range of values for

Q49: A random sample of 40 companies with

Q52: A survey of 25 grocery stores revealed

Q67: Given the following Analysis of Variance table

Q70: The standard error of the estimate measures

Q89: Which shape describes a Poisson distribution?<br>A)Positively skewed<br>B)Negatively

Q96: A confidence interval can be determined for

Q140: The average cost of tuition,room and board