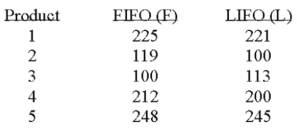

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) .A manufacturer evaluated its finished goods inventory (in $ thousands) for five products both ways.Based on the following results,is LIFO more effective in keeping the value of his inventory lower?  What is the value of calculated t?

What is the value of calculated t?

Definitions:

Q14: A random variable is assigned nominal or

Q25: A random sample of 20 items is

Q44: What is the range of values for

Q61: The production of automobile tires in any

Q62: What is the lowest level of data

Q87: A company wants to study the relationship

Q89: Multiple R<sup>2</sup> measures the proportion of explained

Q93: How do we designate the sample coefficient

Q137: A survey indicates that among eighty people

Q138: What value is the dividing point separating