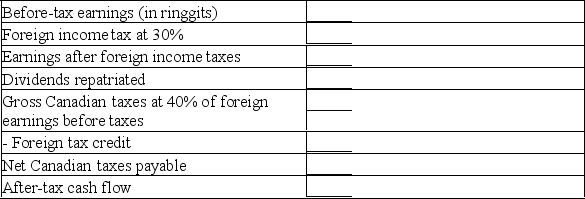

The Daily Planet has a wholly owned foreign subsidiary in Malaysia. The subsidiary earns 25 million ringgits per year before taxes in Malaysia. The foreign income tax rate is 30%. The subsidiary repatriates the entire aftertax profits in the form of dividends to the Daily Planet. The Canadian corporate tax rate is 40% of foreign earnings before taxes.

A) Compute aftertax cash flow to the Daily Planet from this investment (in ringgits).

B) If the exchange rate is.40 ($/ringgits), what is the after tax cash flow in dollars?

B) If the exchange rate is.40 ($/ringgits), what is the after tax cash flow in dollars?

C) CCA related cash flow is 3 million ringgits per year for five years for another Daily Planet investment in Malaysia. The cash flow will earn 10% per year. After five years, it will then be translated back to dollars at an exchange rate of .47 ($/ringgit). The Daily Planet applies a 15% discount rate to foreign cash flows. What is the present value (in dollars) of the CCA related cash flow?

Definitions:

Acetylcholine

A neurotransmitter involved in many functions including muscle activation, heart rate, and the processing of memory and cognition.

Synaptic Cleft

The microscopic gap between neurons across which neurotransmitters are released, facilitating communication between cells.

Neurotransmitter Effects

The impacts or actions exerted by neurotransmitters, which are chemicals responsible for transmitting signals across a chemical synapse between neurons or between neurons and muscles.

Receptors

Proteins located on the surface of or within cells, which bind to specific molecules, triggering a physiological response.

Q11: A rights offering:<br>A) gives a firm a

Q14: The desire to expand management and marketing

Q18: Which of the following type of merger

Q26: Since most foreign currency values fluctuate from

Q33: Common shareholders may assign a proxy, or

Q44: At maturity (Stage IV) the firm will

Q66: Generally the receipt of corporate bond interest

Q73: What is a probability that is based

Q73: Shares purchased through a rights offering may

Q84: The dividend rate paid on floating rate