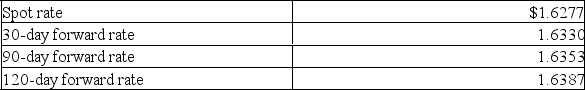

Assume the following spot and forward rates for the euro ($/euro).

A) What is the dollar value of one euro in the spot market?

A) What is the dollar value of one euro in the spot market?

B) Suppose you issued a 120-day forward contract to exchange 200,000 euros into Canadian dollars. How many dollars are involved?

C) How many euros can you get for one dollar in the spot market?

D) What is the 120-day forward premium?

Definitions:

Break-Even Point

The point at which total costs and total revenue are equal, resulting in no net loss or gain for a business.

Net Loss

A financial situation that occurs when a company's total expenses exceed its revenues, indicating a negative profit.

Variable Costs

Costs that change in proportion to the level of activity or volume, such as raw materials and direct labor.

Selling Price

The amount of money a buyer pays to purchase a product or service, determined by factors such as cost, market demand, and competitiveness.

Q3: Translation exposure occurs because of changes in

Q48: To infer something about a population,we usually

Q53: Refer to the following distribution of commissions:

Q57: For a set of data,how many quartiles

Q66: Generally the receipt of corporate bond interest

Q75: A box plot of sales versus production

Q84: A major desire of shareholders regarding dividend

Q105: What is the range for a sample

Q109: A forward rate reflects the future value

Q121: The writer of a call option has