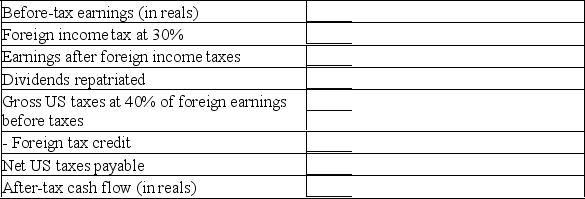

The Daily Planet has a wholly owned foreign subsidiary in Brazil. The subsidiary earns 30 million reals per year before taxes in Brazil. The foreign income tax rate is 30%. The subsidiary repatriates the entire after-tax profits in the form of dividends to the Daily Planet. The U.S. corporate tax rate is 40% of foreign earnings before taxes.

a) Compute after-tax cash flow to the Daily Planet from this investment (in reals). Use the table below.

b) If the exchange rate is.56 ($/reals), what is the after-tax cash flow in dollars?

b) If the exchange rate is.56 ($/reals), what is the after-tax cash flow in dollars?

c) Depreciation related cash flow is 2 million reals per year for five years for another Daily Planet investment in Brazil. The exchange rate is expected to be.59 ($/reals). The Daily Planet applies a 15% discount rate to foreign cash flows. What is the present value (in dollars) of the depreciation related cash flow?

Definitions:

Marginal Revenue

The additional income generated from the sale of one more unit of a product or service.

Total Product

The overall quantity of goods or services produced by a firm within a specific period.

Average Variable Costs

The total variable costs of production divided by the quantity of output produced.

Workers

Individuals engaged in any form of employment, contributing labor for the production of goods or services.

Q3: Poison pills are usually put in place

Q22: Shareholders always have preemptive rights when new

Q37: Bondholders never have any control over the

Q40: The principal difference between the interval and

Q44: In a positively skewed distribution,the mode is

Q51: The major stock repurchase plans often revolve

Q68: Which of the following is not a

Q79: In a merger, the short-term and long-term

Q86: The conversion ratio is the:<br>A) price at

Q97: Cash management considerations tend not to be