The King Solomon Mining Company is contemplating a cash tender offer for the outstanding shares of Roanoke Coal Corporation. Roanoke Coal is expected to provide $162,500 in after-tax cash flow (after tax income plus CCA) each year for the next 20 years. In addition, Roanoke has a $630,000 tax loss carry-forward that King Solomon Mining can use over the next two years ($315,000 per year).

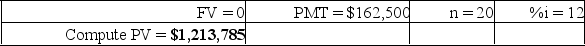

If King Solomon Mining's corporate tax rate is 34% and its cost of capital is 12%, what is the maximum cash price it should be willing to pay to acquire Roanoke?

Present value of after-tax cash flows:

Definitions:

Condition Precedent

A condition in a contract that must be met before a party's obligation or right becomes effective.

Contract

A legally binding agreement between two or more parties that outlines the terms and conditions for the exchange of goods, services, or other forms of consideration.

Statute of Frauds

A legal principle requiring certain types of contracts to be in writing and duly signed by all parties involved, to be enforceable.

Promissory Estoppel

A legal principle that prevents a party from going back on a promise, even if it was not formally agreed to in a contract, if someone else has relied on that promise to their detriment.

Q11: A rights offering:<br>A) gives a firm a

Q18: The fact that interest payments on debt

Q73: A frequency distribution groups data into classes

Q75: If the potential buyer cannot come to

Q80: The midpoint of a class interval is

Q86: Investors in high marginal tax brackets usually

Q95: Why do foreign investments offer higher rates

Q112: In a free market, the exchange rate

Q136: In order to calculate (basic) earnings per

Q165: RC nominal coupon rate is _.<br>A) 3.25%<br>B)