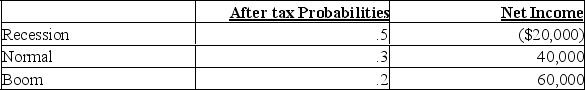

Red River Corporation is considering the purchase of new equipment costing $500,000. The expected life of the equipment is 10 years. It is expected that the new equipment can generate an increase in net income of $60,000 per year for the next 10 years. The probabilities for the increase in net income depend on the state of the economy.

After tax

The equipment can be amortized using straight-line amortization for tax purposes. Red River's cost of capital is 14%. What is the expected NPV? Should they purchase the new equipment? Would your decision change if the cost of capital was 9%? Why or why not?

The equipment can be amortized using straight-line amortization for tax purposes. Red River's cost of capital is 14%. What is the expected NPV? Should they purchase the new equipment? Would your decision change if the cost of capital was 9%? Why or why not?

Definitions:

Osteoclasts

Large bone cells that dissolve bone tissue during growth and healing processes, playing a critical role in bone resorption and remodeling.

Sympathetic Nervous System

Part of the autonomic nervous system that prepares the body for physical activity by accelerating the heart rate, constricting blood vessels, and raising blood pressure among other functions.

Adrenal Gland

An endocrine gland located above the kidney that produces various hormones, including adrenaline and steroids.

Pituitary Gland

A pea-sized gland at the base of the brain that secretes hormones regulating growth, metabolism, and reproductive processes.

Q14: Janex Corp. is refunding $8 million worth

Q17: The reason cash flow is used in

Q19: Explain the Internal Rate of Return (IRR)

Q50: According to traditional financial theory, the cost

Q52: The appropriate discount rate for bonds is

Q58: The inflation premium is based on past

Q78: Establishing a creditor committee to run the

Q94: This project's expected profit is _.<br>A) $5,000<br>B)

Q104: In the Net Operating Income approach to

Q132: When both the tax deductibility of debt