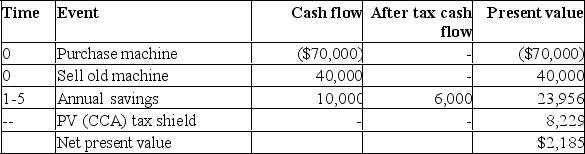

The Taylor Corporation is using a machine that originally cost $66,000. The machine has a book value of $66,000 and a current market value of $40,000. The asset is in the Class 8 CCA pool. It will have no salvage value after 5 years and the company tax rate is 40%.

Jacqueline Elliott, the Chief Financial Officer of Taylor, is considering replacing this machine with a newer model costing $70,000. The new machine will cut operating costs by $10,000 each year for the next five years. Taylor's cost of capital is 8%.

Should the firm replace the asset? (Use NPV methodology to solve this problem.)

Definitions:

Diversity Issues

Concerns and challenges related to the varied dimensions of diversity, including race, ethnicity, gender, sexuality, disability, and culture, among others.

Marginalization

The process by which individuals or groups are pushed to the periphery of society, limiting their access to resources and opportunities.

Counselor Responsibility

The ethical, professional, and personal duties a counselor has toward their clients, including confidentiality, competence, and integrity.

Treatment Plan

A systematic strategy designed by a therapist or healthcare provider to address a patient's diagnosis, including therapeutic goals and methodologies.

Q17: A bankers' acceptance:<br>A) is a draft drawn

Q19: An issue of common stock is expected

Q29: Leveraged buyouts usually entail the use of

Q37: In January, Harold Black bought 100 shares

Q54: SFC's EPS would be _ without the

Q60: Laura's Book Shoppe is going to borrow

Q71: Within the capital asset pricing model:<br>A) the

Q72: A characteristic of capital budgeting is:<br>A) a

Q78: A "what if" simulation using a computer

Q84: Random walk theory generally supports weak form