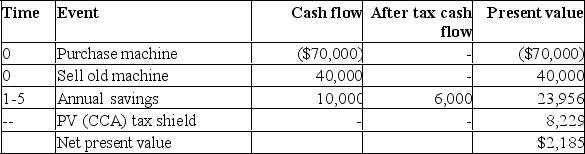

The Taylor Corporation is using a machine that originally cost $66,000. The machine has a book value of $66,000 and a current market value of $40,000. The asset is in the Class 8 CCA pool. It will have no salvage value after 5 years and the company tax rate is 40%.

Jacqueline Elliott, the Chief Financial Officer of Taylor, is considering replacing this machine with a newer model costing $70,000. The new machine will cut operating costs by $10,000 each year for the next five years. Taylor's cost of capital is 8%.

Should the firm replace the asset? (Use NPV methodology to solve this problem.)

Definitions:

Dissociation

The process by which a member's involvement in an entity is terminated, typically in the context of a partnership or limited liability company.

Capital Contribution

Capital contribution refers to the funds, assets, or other resources a partner or shareholder provides to a partnership or corporation to support its operations or increase its equity.

Partnership Debts

Financial obligations or liabilities that a partnership, as a business entity, is responsible for.

Liability

A legal obligation or responsibility for any debts or damages incurred.

Q1: Modigliani and Miller originally suggested that firm

Q8: In the equation K<sub>j</sub> = R<sub>f</sub> +

Q20: The bank rate is determined by:<br>A) the

Q40: Carol Thomas will pay out $6,000 at

Q43: The Dammon Corp. has the following investment

Q49: Projects that are negatively correlated:<br>A) cut down

Q82: The fact that small businesses are usually

Q94: If g is greater than k, the

Q105: Securitized paper:<br>A) is not part of the

Q131: An asset just purchased, qualifies for a