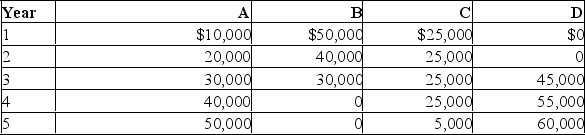

A&B Enterprises is trying to select the best investment from among four alternatives. Each alternative involves an initial outlay of $100,000. Their cash flows follow:

Evaluate and rank each alternative based on a) payback period, b) net present value (use a 10% discount rate), and c) internal rate of return.

Evaluate and rank each alternative based on a) payback period, b) net present value (use a 10% discount rate), and c) internal rate of return.

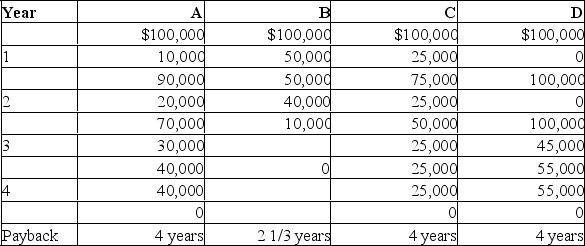

A) Payback period

Based on payback period, our choice is B.

Based on payback period, our choice is B.

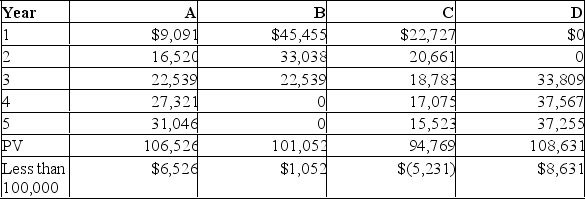

B) Net present value (NPV)

PV of Inflows @ 10%

Based on net present value analysis, our first choice is D, followed by A, then

Based on net present value analysis, our first choice is D, followed by A, then

B. We would not select alternative C.

C) Internal rate of return (IRR)

Definitions:

Archaea

A category of single-celled organisms, distinct in genetics from both bacteria and eukaryotes, frequently located in environments of extreme conditions.

Extrinsic Postzygotic

Refers to factors external to the zygote that affect the survival and reproduction of hybrids between different species, populations, or genetic backgrounds.

Genetic Drift

A mechanism of evolution where random changes in the frequency of alleles within a population occur, often having a significant impact on smaller populations.

Q1: Which of the following is not true

Q6: Tabletop Ranches, Inc. is considering the purchase

Q14: Bank loans to business firms:<br>A) are usually

Q37: An increase in the risk-free rate causes

Q63: A 20-year bond pays 12% annual interest

Q85: New common stock is more expensive than

Q93: Which of the following is a true

Q97: The pre-tax cost of debt for a

Q103: What is this project's NPV if the

Q135: Each project should be judged against:<br>A) the