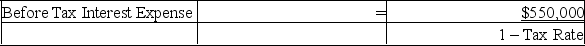

Blink and Wink (BW) manufactures contact lens. In its most recent fiscal year BW reported after-tax interest expense on a new bond issue of $550,000. If BW's effective tax rate is 35%, what was the firm's before tax interest expense?

Definitions:

Accrual Basis Accounting

An accounting method where revenues and expenses are recorded when earned or incurred, regardless of when the cash transactions occur.

Statement of Retained Earnings

A financial statement that shows the changes in a company's retained earnings over a specific period.

Net Income

The remaining profit of a company post deduction of all expenses, taxes, and costs from its total revenues.

Unearned Revenues

Income received by a company for goods or services to be provided in the future, which is recorded as a liability until earned.

Q15: Calculate the tax bill for a corporation

Q15: The following data were reported for Favre

Q20: The DuPont system of profitability analysis emphasizes

Q41: Which of the following statements about earnings

Q42: Firms with a high degree of operating

Q61: Which of the following statements about the

Q73: Bailey Corporation reported the following information for

Q115: Preferred stock is always excluded from shareholders'

Q117: The primary disadvantage of accrual accounting is

Q121: As defined by the text, list each