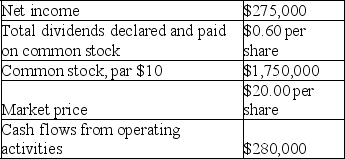

The following data were reported for Favre Company:

Calculate each of the following ratios.Round your answers to two decimal places.

Calculate each of the following ratios.Round your answers to two decimal places.

A.Dividend yield

B.Price/earnings ratio

C.Quality of income

Definitions:

Effective-Interest Method

An accounting method to amortize the discount or premium on bonds payable or receivable over the bond's life, reflecting a constant rate of interest.

Market Rate

The current price or interest rate at which a good, service, or financial asset can be bought or sold in a competitive market.

Journal Entry

An accounting transaction entered into a ledger that denotes the financial activities of a company.

Statement of Cash Flows

A summary statement which tracks all cash inflows to a company from its regular business operations and funds received from investments, plus all cash outflows for paying business and investment costs within a certain period.

Q9: Recently, the emphasis of financial management has

Q10: Which of the following best describes the

Q36: Setting a goal of profit maximization has

Q37: The records of Everyday Electronics Corporation for

Q38: What 4 factors will investors consider in

Q61: Cash flow consists of illiquid cash equivalents

Q62: A firm has a Debt-to-Asset ratio of

Q82: Broadbean Co.had the following amounts on its

Q100: The 1990s demonstrated that the old valuation

Q121: The quality of income ratio increases when