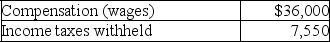

The following data were provided by the detailed payroll records of Mountain Corporation for the last week of March 2019,which will not be paid until April 5,2019:

FICA taxes at a 7.65% rate (no employee had reached the maximum).

FICA taxes at a 7.65% rate (no employee had reached the maximum).

A.Prepare the March 31,2019 journal entry to record the payroll and the related employee deductions.

B.Prepare the March 31,2019 journal entry to record the employer's FICA payroll tax expense.

C.Calculate the total payroll-related liabilities at March 31,2019 using the results of requirements (A)and (B).

Definitions:

Interchangeable Parts

A manufacturing system where components are made to such precise standards that they can be swapped with similar parts in other assemblies without custom fitting.

Eli Terry

An American clockmaker from the early 19th century, known for his role in developing mass production techniques in clockmaking, significantly impacting the industry.

German Immigrants

Individuals from Germany who migrated to another country, significantly impacting the cultural and social composition of their new communities, especially in the 19th and early 20th centuries.

Craftsmen

Skilled workers who create products using their hands, often employing traditional techniques in various trades such as carpentry, metalwork, or weaving.

Q26: An annuity is a series of consecutive

Q42: Assuming no adjusting journal entries have been

Q44: Which of the following would be subtracted

Q50: A grocery store would likely use the

Q102: Which of the following is incorrect

Q103: Matrix Corp.reported the following figures from its

Q104: During 2019,Edna Enterprises had a capital acquisitions

Q107: Which of the following statements is correct?<br>A)Current

Q119: The declaration and issuance of a stock

Q127: A loan supported by an agreement to