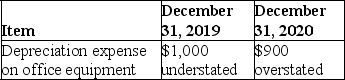

The financial statements of Franklin Company contained the following errors:

A.Was net income for 2019 understated or overstated? Briefly explain your answer.

A.Was net income for 2019 understated or overstated? Briefly explain your answer.

B.1.Considering the effect of the errors of both years at December 31,2020,is retained earnings overstated or understated,and by what amount?

2.Briefly explain your answer to part B (1).

Definitions:

Pretax Income

The income a company generates before any taxes are deducted.

Q15: Which of the following statements regarding the

Q22: Generally,inventory inspection costs are reported as operating

Q48: Dillon Company uses the allowance method to

Q49: In Year 4,Landmark Restaurants reported the cost

Q51: Merchandise was sold on credit for $10,000,terms

Q63: Morgan Company used supplies in the amount

Q72: Which of the following statements does not

Q86: An overstatement of the 2019 ending inventory

Q90: A company has a December 31 fiscal

Q125: The cash account and the December bank