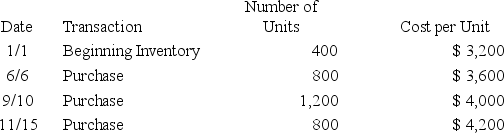

RJ Corporation has provided the following information about one of its inventory items:  During the year,RJ sold 3,000 units.

During the year,RJ sold 3,000 units.

-

What was ending inventory using the LIFO cost flow assumption?

Definitions:

Corporate Taxes

Taxes imposed on the income or profit of corporations, influencing their financial strategies and profitability.

EBIT

Stands for Earnings Before Interest and Taxes; it's a financial metric that calculates a company's profitability by excluding interest and income tax expenses.

Debt

Money that is owed or due to be paid to someone else, often as a result of borrowing funds or purchasing goods and services on credit.

Fixed Costs

These are expenses that do not change with the level of goods or services produced by the business within a certain range of activity or over a certain period.

Q10: Information on all contractual agreements is included

Q23: An objective of preparing the bank reconciliation

Q32: Which of the following does not correctly

Q53: The Securities & Exchange Commission requires publicly

Q73: Income taxes payable is an example of

Q82: Why are present value concepts and applications

Q93: Which of the following is correct?<br>A)The raw

Q95: Jennings Company uses FIFO inventory costing.At the

Q95: Which of the following costs is most

Q114: What is the purpose of adjusting entries?