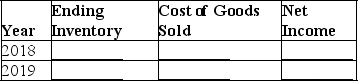

Redford Company hired a new store manager in October 2018,who determined the ending inventory on December 31,2018,to be $50,000.In March,2019,the company discovered that the December 31,2018 ending inventory should have been $58,000.The December 31,2019,inventory was correct.Ignore income taxes.

Complete the following table to show the effects of the inventory error on the four amounts listed.Give the amount of the discrepancy and indicate whether it was overstated (O),understated (U),or had no effect (N).

Definitions:

Modified Accrual Accounting

This accounting method recognizes revenues when they become available and measurable and expenses when incurred, blending elements of both cash and accrual accounting.

Accrual Accounting

An accounting method where revenue and expenses are recorded when they are earned or incurred, regardless of when the cash is received or paid.

Proprietary Fund Types

Types of funds used by governmental entities to account for activities similar to those found in the private sector, where the intent is to recover costs through user charges.

Internal Service Funds

Funds used by a government entity to account for the services provided by one department to other departments on a cost-reimbursement basis.

Q8: For the year ending December 31,2019,the accounts

Q11: Which one of the following accounts would

Q14: Which of the following statements is correct?<br>A)Dividend

Q16: Natural resource depletion is recognized on the

Q32: Interest expense is reported on the income

Q37: <br>What was cost of goods sold using

Q94: Which of the following is correct regarding

Q96: Using cash to purchase office supplies,which will

Q104: Which of the following is not a

Q122: Under what conditions would a company most