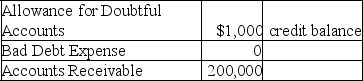

Prior to the year-end adjustment to record bad debt expense for 2019 the general ledger of Stickler Company included the following accounts and balances:

Cash collections on accounts receivable during 2019 amounted to $450,000.Sales revenue during 2019 amounted to $800,000,of which 75% was on credit,and it was estimated that 2% of these credit sales made in 2019 would ultimately become uncollectible.

Cash collections on accounts receivable during 2019 amounted to $450,000.Sales revenue during 2019 amounted to $800,000,of which 75% was on credit,and it was estimated that 2% of these credit sales made in 2019 would ultimately become uncollectible.

A.Calculate the bad debt expense for 2019.

B.Determine the adjusted 2019 year-end balance of the allowance for doubtful accounts.

C.Determine the net realizable value of accounts receivable for the December 31,2019 balance sheet.

Definitions:

Q9: Which of the following statements regarding the

Q14: An asset account normally has a debit

Q38: Phipps Company borrowed $25,000 cash on October

Q47: Which of the following transactions will result

Q48: Warren Company plans to depreciate a new

Q54: Which of the following accounts requires a

Q65: Which of the following statements is false

Q67: The building reported on the balance

Q88: Which of the following describes the impact

Q101: A transaction may be an exchange of