Four transactions described below were completed during 2019 by Russell Company.The books are adjusted only at year-end.

A.On December 31,2019,Russell Company owed employees $3,750 for wages that were earned by them during December and were not recorded.

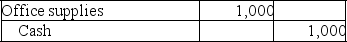

B.During 2019,Russell Company purchased office supplies that cost $1,000,which were placed in the supplies room for use as needed.The purchase was recorded as follows:

At January 1,2019,the amount of unused office supplies was $300.At December 31,2019,a physical count showed unused office supplies in the supply room amounting to $100.

At January 1,2019,the amount of unused office supplies was $300.At December 31,2019,a physical count showed unused office supplies in the supply room amounting to $100.

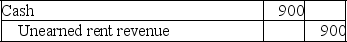

C.On December 1,2019,Russell Company rented some office space to another party.Russell Company collected $900 rent for the period December 1,2019,to March 1,2020.The December 1 transaction was recorded as follows:

D.On July 1,2019,Russell Company borrowed $12,000 cash on a one-year,8% interest-bearing note payable.The interest is payable on the due date of the note,June 30,2020.The borrowing was recorded as follows on July 1,2019:

D.On July 1,2019,Russell Company borrowed $12,000 cash on a one-year,8% interest-bearing note payable.The interest is payable on the due date of the note,June 30,2020.The borrowing was recorded as follows on July 1,2019:

Provide the adjusting entries required for Russell Company on December 31,2019.

Provide the adjusting entries required for Russell Company on December 31,2019.

Definitions:

Allowed Fee

The maximum charge that an insurance plan agrees to cover for a specific medical service or procedure.

Medicare Beneficiary

An individual who is eligible to receive health care benefits under the Medicare program, typically because of age or disability.

ABN

An abbreviation often used for "Advanced Beneficiary Notice," which is a notice given to patients under Medicare to convey that Medicare may not provide coverage for certain procedures or services.

Formulary

An insurance plan’s list of approved prescription medications.

Q23: Which of the following statements is correct?<br>A)Income

Q29: During 2019,Sigma Company earned service revenue amounting

Q31: Coulter Company uses the LIFO inventory method.The

Q31: The Callie Company has provided the following

Q33: The equity investment portfolio is adjusted to

Q89: The Tanner Company's April 30 pre-reconciliation cash

Q91: Assets are reported on the balance sheet

Q105: Which of the following would result when

Q130: The comparative balance sheets of Titan Company

Q135: The records of Jimmy Company show 2019