Four transactions described below were completed during 2019 by Russell Company.The books are adjusted only at year-end.

A.On December 31,2019,Russell Company owed employees $3,750 for wages that were earned by them during December and were not recorded.

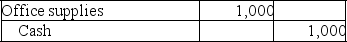

B.During 2019,Russell Company purchased office supplies that cost $1,000,which were placed in the supplies room for use as needed.The purchase was recorded as follows:

At January 1,2019,the amount of unused office supplies was $300.At December 31,2019,a physical count showed unused office supplies in the supply room amounting to $100.

At January 1,2019,the amount of unused office supplies was $300.At December 31,2019,a physical count showed unused office supplies in the supply room amounting to $100.

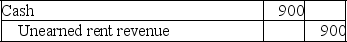

C.On December 1,2019,Russell Company rented some office space to another party.Russell Company collected $900 rent for the period December 1,2019,to March 1,2020.The December 1 transaction was recorded as follows:

D.On July 1,2019,Russell Company borrowed $12,000 cash on a one-year,8% interest-bearing note payable.The interest is payable on the due date of the note,June 30,2020.The borrowing was recorded as follows on July 1,2019:

D.On July 1,2019,Russell Company borrowed $12,000 cash on a one-year,8% interest-bearing note payable.The interest is payable on the due date of the note,June 30,2020.The borrowing was recorded as follows on July 1,2019:

Provide the adjusting entries required for Russell Company on December 31,2019.

Provide the adjusting entries required for Russell Company on December 31,2019.

Definitions:

Consolidated Balance Sheet

A comprehensive financial statement presenting the total assets, liabilities, and shareholder equity of a parent company and its subsidiaries as a single entity.

Common Shares

Equity securities that represent ownership in a corporation, granting voting rights and a share in the company's profits through dividends.

Equity Method

An accounting technique used for recording investments in which the investor has significant influence over the investee, but not full control.

Straight Line Amortization

A method of allocation of an asset's cost over its useful life in equal annual amounts.

Q6: Which of the following correctly describes the

Q12: Which of the following is the amount

Q21: Mama June Pizza Company sold land costing

Q26: The journal entry to adjust the prepaid

Q32: As of January 1,2019,a corporation had assets

Q79: Madison Inc.acquires 100% of the voting stock

Q89: <br>What was Nellie's income before taxes?<br>A)$514,000.<br>B)$612,000.<br>C)$497,000.<br>D)$298,000.

Q120: On January 1,2019,the general ledger of Global

Q133: Which of the following would be classified

Q137: At December 31,2019,the following adjusting entries were