Three transactions described below were completed during 2019 by Story Company.

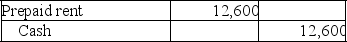

A.On June 1,2019,Story Company paid $12,600 for one year's rent beginning on that date.The rent payment was recorded as follows:

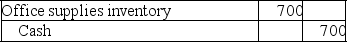

B.On February 1,2019,Story Company purchased office supplies that cost $700 and placed the supplies in a storeroom for use as needed.The purchase was recorded as follows:

B.On February 1,2019,Story Company purchased office supplies that cost $700 and placed the supplies in a storeroom for use as needed.The purchase was recorded as follows:

C.On December 31,2019,Story Company owed employees $2,000 for wages earned during December.These wages had not been paid or recorded.

C.On December 31,2019,Story Company owed employees $2,000 for wages earned during December.These wages had not been paid or recorded.

Prepare the adjusting entries as of December 31,2019,assuming no adjusting entries have been made during the year.

Definitions:

Oil Imported

The total volume of crude oil and petroleum products that a country acquires from foreign sources to meet its energy and fuel needs.

Dividends

Payments by a corporation of all or part of its profit to its stockholders (the corporate owners).

Direct Investment

Describes the process of acquiring a controlling interest in foreign assets, such as a company or property, with the aim of managing the investment directly.

Japanese Company

A business entity registered and operating in Japan, often characterized by its management style and hierarchical structure.

Q2: Which of the following does not correctly

Q6: Classify the following balance sheet accounts as

Q46: Financial reporting focuses on reporting the impact

Q90: Inventory turnover is calculated as cost of

Q94: Which of the following statements is <b>false</b>?<br>A)The

Q101: Which of the following statements does not

Q104: Which of the following is not a

Q111: An understatement of ending inventory results in

Q114: Which of the following statements is correct

Q118: Which of the following journal entries is