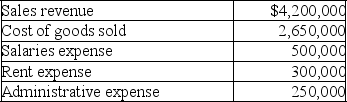

For Glad Rags Shops,the following information is available for the year ended December 31,2019:

Dividends declared $10,000

Dividends declared $10,000

The income tax expense is $150,000.

Prepare an income statement for Glad Rags Shops.

Definitions:

Paid-Time-Off Plans

Employee benefit programs that offer a pool of days for vacation, sick leave, and personal time, which employees can use at their discretion.

PTOs

Paid Time Off; a policy that combines vacation, sick leave, and personal leave into a single bank of days for employees to use at their discretion.

Work-Life Balance

The equilibrium between personal life and career work, where neither is neglected.

Voluntary Protection Programs

Cooperative initiatives between employers and government agencies to implement or enhance safety and health management systems at workplaces.

Q4: On January 31,2018,McBurger Corporation purchased the following

Q6: What effect will the dividend have

Q7: Which is the correct sequence of the

Q8: The cost of not taking the discount

Q31: Determine the effect of the following errors

Q33: The equity investment portfolio is adjusted to

Q81: Describe the 7 characteristics of most market

Q96: Which of the following transactions would result

Q96: SWIFT has combated the growing issue of

Q138: Which of the following statements is <b>true</b>?<br>A)Contributed