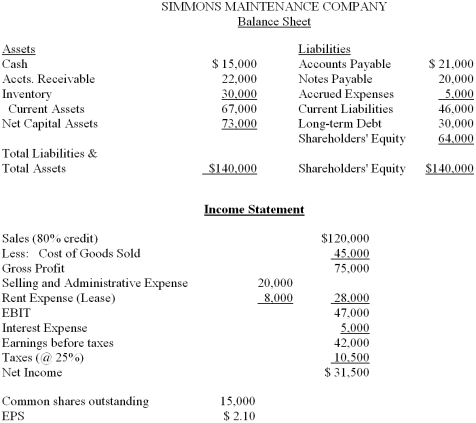

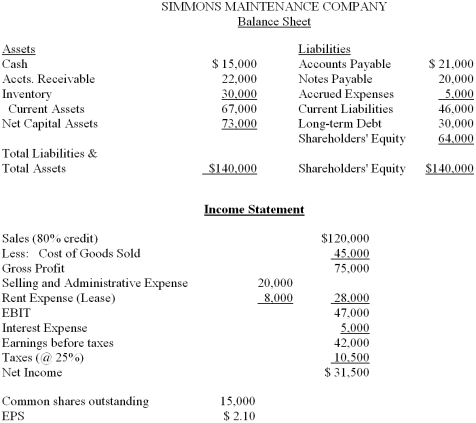

Given the balance sheet and income statement for Simmons Maintenance Company, compute the ratios below. The "right answer" refers to the question of whether a particular ratio for Simmons is better or worse than the industry average.  Ratio Profit margin Return on investment Return on equity Receivables turnover Avg. collection period Inventory turnover Capital asset turnover Total asset turnover Current ratio Quick ratio Debt to total assets Times interest earned Fixed charge coverage Ratios for Simmons Industry Average 17.5%20.8%35%4.4x68.0 days 3.5x2.4x.76x1.28.85.4512.0x3.6x Circle the right answer better worse better worse better worse better worse better worse better worse better worse better worse better worse better worse better worse better worse better worse

Ratio Profit margin Return on investment Return on equity Receivables turnover Avg. collection period Inventory turnover Capital asset turnover Total asset turnover Current ratio Quick ratio Debt to total assets Times interest earned Fixed charge coverage Ratios for Simmons Industry Average 17.5%20.8%35%4.4x68.0 days 3.5x2.4x.76x1.28.85.4512.0x3.6x Circle the right answer better worse better worse better worse better worse better worse better worse better worse better worse better worse better worse better worse better worse better worse

Bona Fide Occupational Qualification

A Bona Fide Occupational Qualification (BFOQ) is a legal term that allows employers to hire individuals based on attributes normally considered discrimination if they are reasonably necessary to the normal operation of a particular business.

Equal Employment Opportunity Commission

A federal agency in the United States charged with enforcing laws that prohibit discrimination in employment.

Protected Classes

Refers to the groups of people legally protected from discrimination and harassment in the workplace by law.

Flextime

Scheduling system that allows employees to set their own work hours within constraints specified by the firm.