Product Profitability and Mix - Calculating Variable Overhead

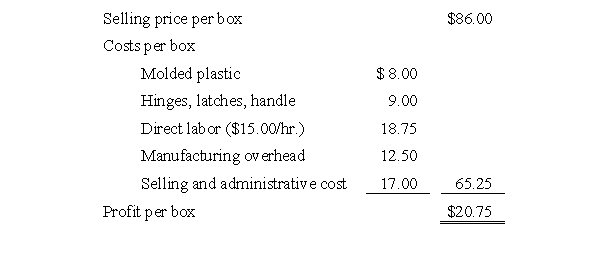

Sportway Inc. is a wholesale distributor supplying a wide range of moderately priced sporting equipment to large chain stores. About 60 percent of Sportway's products are purchased from other companies and the remainder are manufactured by Sportway. The company has a plastics department that is currently manufacturing molded fishing tackle boxes. Sportway is able to manufacture and sell 8,000 tackle boxes annually, making full use of its direct labor capacity at available workstations. Presented below are the selling price and costs associated with Sportway's tackle boxes.  Because Sportway believes it could sell 12,000 tackle boxes if it had sufficient manufacturing capacity, the company has looked into the possibility of purchasing the tackle boxes for distribution. Maple Products, a steady supplier of quality products, would be able to provide up to 9,000 tackle boxes per year at a price of $68 per box delivered to Sportway's facility.

Because Sportway believes it could sell 12,000 tackle boxes if it had sufficient manufacturing capacity, the company has looked into the possibility of purchasing the tackle boxes for distribution. Maple Products, a steady supplier of quality products, would be able to provide up to 9,000 tackle boxes per year at a price of $68 per box delivered to Sportway's facility.

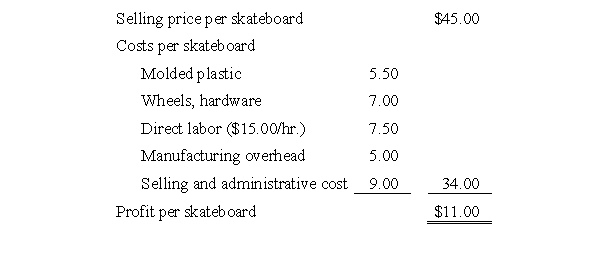

Bart Johnson, Sportway's product manager, has suggested that the company could make better use of its plastics department by manufacturing skateboards. To support his position, Johnson has a market study that indicates an expanding market for skateboards and a need for additional suppliers. Johnson believes that Sportway could expect to sell 17,500 skateboards annually at $45 per skateboard. Johnson's estimate of the costs to manufacture the skateboards follows.  In the plastics department, Sportway uses direct labor hours as the application base for manufacturing overhead. Included in manufacturing overhead for the current year is $50,000 of factorywide, fixed manufacturing overhead that has been allocated to the plastics department. For each product that Sportway sells, regardless of whether the product has been purchased or is manufactured by Sportway, a portion of the selling and administrative cost is fixed at $6 per unit. Total selling and administrative costs for the purchased tackle boxes would be $10 per unit.

In the plastics department, Sportway uses direct labor hours as the application base for manufacturing overhead. Included in manufacturing overhead for the current year is $50,000 of factorywide, fixed manufacturing overhead that has been allocated to the plastics department. For each product that Sportway sells, regardless of whether the product has been purchased or is manufactured by Sportway, a portion of the selling and administrative cost is fixed at $6 per unit. Total selling and administrative costs for the purchased tackle boxes would be $10 per unit.

Required:

Prepare an analysis based on the data presented that will show which product or products Sportway Inc. should manufacture and/or purchase to maximize the company's profitability. Show the associated financial impact. Support your answer with appropriate calculations.

Definitions:

Socially Condemned

Actions or behaviors that are widely disapproved or denounced by society due to violating shared norms, morals, or ethics.

Warfare

Armed conflict between parties, such as nations or groups, characterized by the use of military force to achieve political or social objectives.

Jigsaw Learning Groups

An educational approach where students are divided into groups with each member assigned a piece of information; they are then required to teach each other, ensuring collective learning.

Conflict Management

The practice of identifying and handling conflicts in a sensible, fair, and efficient manner, often with the goal of reaching a resolution that is acceptable to all parties involved.

Q5: Sensitivity training emphasizes changing behavior through structured

Q9: Explain the primary methods of maintaining an

Q16: Linking Decision Rights and Knowledge<br>Professional football teams

Q32: The increasing percentage ownership of public corporations

Q47: Different Types of Budgets<br>The Sticky Company makes

Q47: Provide a workplace example of informal training

Q51: You have just been appointed as director

Q53: A rapid payback may be important to

Q58: The financial markets value assets based on

Q66: Timing is not a particularly important consideration