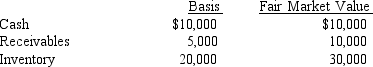

The Dominguez Partnership has the following assets on December 31:  Antonio is a 20 percent partner and has a $7,000 basis in his partnership interest. The partnership has no liabilities. Antonio receives a liquidating distribution of $10,000 cash. What is the amount and character of the gain or income Antonio recognizes on this liquidating distribution?

Antonio is a 20 percent partner and has a $7,000 basis in his partnership interest. The partnership has no liabilities. Antonio receives a liquidating distribution of $10,000 cash. What is the amount and character of the gain or income Antonio recognizes on this liquidating distribution?

Definitions:

Sales Presentation

A pitch or demonstration given by a salesperson to a potential buyer, with the aim of promoting and selling a product or service.

Approach Technique

Strategies used by salespeople to initiate contact with potential customers effectively.

Inexperienced Salespeople

Sales personnel who are new to the field and may lack the skills, knowledge, or confidence of their more experienced counterparts.

Organic Garden Products

Materials and substances used in gardening that are derived from natural sources and do not contain synthetic chemicals.

Q17: Cloud Corporation has a taxable income of

Q22: Martone Corporation sells two machines and a

Q39: When may a taxpayer deduct a casualty

Q42: A general partner in a limited partnership

Q54: Gain recognized by owners on liquidation of

Q57: Actively and constructively attempting to improve conditions

Q79: According to Mintzberg's classification of managerial roles,

Q82: For a nonsimultaneous exchange to qualify for

Q85: Transfer of a house valued at $500,000

Q99: The following properties have been owned by