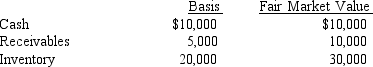

The Dominguez Partnership has the following assets on December 31:  Antonio is a 20 percent partner and has a $7,000 basis in his partnership interest. The partnership has no liabilities. Antonio receives a liquidating distribution of $10,000 cash. What is the amount and character of the gain or income Antonio recognizes on this liquidating distribution?

Antonio is a 20 percent partner and has a $7,000 basis in his partnership interest. The partnership has no liabilities. Antonio receives a liquidating distribution of $10,000 cash. What is the amount and character of the gain or income Antonio recognizes on this liquidating distribution?

Definitions:

Fiduciary Duty

A legal obligation requiring one party to act in the best interest of another when entrusted with care or responsibility for their property or welfare.

Breached

The act of breaking or failing to observe a law, agreement, or code of conduct.

Real Estate

Property consisting of land and the buildings on it, along with its natural resources and rights.

Legal Position

A statement or principle of law that pertains to a particular factual situation, representing an argument or standpoint in legal proceedings.

Q11: An income interest in a trust<br>A) must

Q12: Corporate net capital gains receive no tax-favored

Q17: Crystal deposited $50,000 into a joint savings

Q24: Which of the following is the best

Q25: Charles gave his three grandsons $20,000 each,

Q35: Attitudes that our memories can easily access

Q37: What is the purpose of the kiddie

Q46: Greg and Samantha plan to establish a

Q87: James corporation exchanges a building (fair market

Q103: _ refers to a gut feeling not