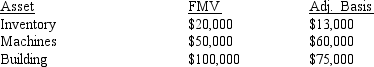

What is Alexander's net gain or loss on the liquidation of his 100 percent interest in an S corporation if the corporation distributes the following three assets to him in exchange for his stock:  Prior to any distributions, Alexander's basis in his S corporation interest was $160,000.

Prior to any distributions, Alexander's basis in his S corporation interest was $160,000.

Definitions:

Opposing Traits

Characteristics in a personality that are contradictory or contrast directly with each other.

Rating Scale

A set of categories designed to elicit information about a quantitative or a qualitative attribute.

Likert-Type Scale

A psychometric scale often used in questionnaires, where respondents specify their level of agreement to a statement typically in a five or seven-point scale.

Empathic Responses

Emotional reactions that show an understanding of and compassion for another's situation, feelings, and motives.

Q9: The tax on generation skipping transfers has

Q18: The GGH Corporation, a calendar-year, accrual-basis corporation,

Q26: The Schedule L of Form 1120 is

Q26: Stewart is a 30 percent general partner

Q31: According to Mintzberg's classification of managerial roles,

Q37: Clem and Chloe, a married couple, sell

Q38: Mary and Doris form MD general partnership.

Q40: What is a major advantage of the

Q108: Caldwell Corporation sold a factory building for

Q108: Bertam transfers property with a $50,000 mortgage,