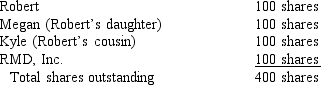

The outstanding stock of Riccardo Corporation is owned as follows:  Robert owns 50% of RMD, Inc. stock. The rest of RMD, Inc. stock is owned by unrelated parties. Riccardo Corporation redeems 90 of Robert's shares of stock for $9,000 in the only redemption transaction this year. Robert's basis for his stock is $10 per share (100 shares @ $10 = $1,000) . Riccardo Corporation has $300,000 in E&P. What is Robert's total basis in his remaining 10 shares of stock after the redemption?

Robert owns 50% of RMD, Inc. stock. The rest of RMD, Inc. stock is owned by unrelated parties. Riccardo Corporation redeems 90 of Robert's shares of stock for $9,000 in the only redemption transaction this year. Robert's basis for his stock is $10 per share (100 shares @ $10 = $1,000) . Riccardo Corporation has $300,000 in E&P. What is Robert's total basis in his remaining 10 shares of stock after the redemption?

Definitions:

Fair Value Movements

describes changes in the fair value of an asset or liability over time, which may be recognized in profit or loss or other comprehensive income.

AASB 141

The Australian Accounting Standards Board document that outlines the accounting treatment for agricultural activity.

IAS 41

International Accounting Standard 41 relates to agriculture. It prescribes the accounting treatment and disclosures related to agricultural activity.

Agricultural Produce

Products that result from the cultivation and harvest of plants, animals, and other organic materials for human consumption and use.

Q23: Cost of a hunting lodge available for

Q48: Bamboo Corporation has $130,000 of operating income,

Q50: When would it be advisable to use

Q71: Which type of reorganization involves only one

Q85: Which of the following terms best describes

Q89: A large corporation had a net long-term

Q91: When comparing lifetime transfers to testamentary transfers,

Q94: YumYum Corporation (a calendar-year corporation) moved into

Q110: Bill has a $15,000 passive loss, a

Q119: Corbin has a $15,000 basis in his