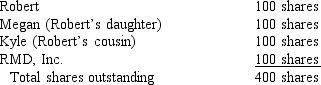

The outstanding stock of Riccardo Corporation is owned as follows:  Robert owns 50% of RMD, Inc. stock. The rest of RMD, Inc. stock is owned by unrelated parties. Riccardo Corporation redeems 90 of Kyle's shares of stock for $9,000 in the only redemption transaction this year. Kyle's basis for his stock is $10 per share. Riccardo Corporation has $300,000 in E&P. How much capital gain or dividend income does Kyle recognize as a result of this redemption?

Robert owns 50% of RMD, Inc. stock. The rest of RMD, Inc. stock is owned by unrelated parties. Riccardo Corporation redeems 90 of Kyle's shares of stock for $9,000 in the only redemption transaction this year. Kyle's basis for his stock is $10 per share. Riccardo Corporation has $300,000 in E&P. How much capital gain or dividend income does Kyle recognize as a result of this redemption?

Definitions:

Client Consent

Agreement from a client, often required by law or professional standards, before certain actions are undertaken on their behalf.

Professional Negligence

The failure of a professional to perform their duties with the competence that their profession requires, resulting in harm or loss.

IRS

The Internal Revenue Service (IRS) is the U.S. government agency responsible for the collection of taxes and enforcement of tax laws.

Supermart

A large retail store, typically a supermarket or hypermarket, selling a wide variety of goods.

Q4: What is the control requirement to qualify

Q10: Alpha Corporation's adjusted taxable income is $100,000

Q16: Which of the following is a taxable

Q23: Which of the following functions do managers

Q34: What is JEB Corporation's taxable income and

Q38: There has been a significant decrease in

Q84: A transfers machines valued at $170,000 (basis

Q90: Sam has $80,000 of net income from

Q110: In 2017, a personal theft loss could

Q113: Sanjuro Corporation (a calendar-year corporation) purchased and