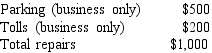

Haley, a self-employed individual, drove her automobile a total of 20,000 business miles in 2018. This represents about 75% of the auto's use. She has receipts as follows:  If Haley uses the standard mileage rate method, how much can she deduct as a business expense?

If Haley uses the standard mileage rate method, how much can she deduct as a business expense?

Definitions:

Family Structure

The composition and organization of a family unit, including the relationships and roles between its members, which can vary widely across different cultures and societies.

Judicial Proceeding

A proceeding or action brought in a court to resolve a dispute or enforce a right.

Public Law

A body of law that governs relationships between individuals and the government, including constitutional, administrative, and criminal laws.

Litigation

The process of taking legal action or engaging in a lawsuit to resolve disputes between parties.

Q1: A parent cannot be considered as a

Q3: How is qualified business income (QBI) defined

Q37: Clem and Chloe, a married couple, sell

Q41: Harris Corporation granted Tyler 1,000 stock appreciation

Q58: Loan forgiven by father

Q63: A taxpayer cannot take a deduction for

Q70: A married person filing a separate return

Q71: Which of the following is not a

Q90: All of the following are allowable tax

Q98: A calendar year always ends on December