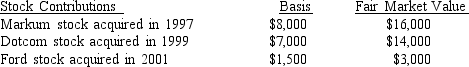

What is Beth's maximum allowable deduction for the following contributions to qualified public charities during the current year if her adjusted gross income is $90,000?

Definitions:

Contrast Connectors

Words or phrases used to highlight differences or distinctions between ideas in writing or speech.

Coherence Techniques

Methods or strategies used to ensure the logical flow and consistency of ideas in speech or writing.

Error Detection

The process in computing and communications to identify errors in data transmission or storage.

User-Friendly

Refers to a design or interface that is easy to use or interact with, enhancing the user's experience.

Q5: Abby has a $10,000 loss on some

Q6: What is the unextended due date for

Q8: A business sells a machine used in

Q25: Which of the following are characteristics of

Q39: On November 1, 2018, Hernandez Corporation (a

Q45: What is a phantom stock plan?<br>A) A

Q58: Margo is single and has twin sons

Q62: Barry's firm purchases a $31,000 automobile for

Q91: What are the steps that are usually

Q92: The statute of limitations for a return