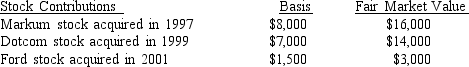

What is Beth's maximum allowable deduction for the following contributions to qualified public charities during the current year if her adjusted gross income is $90,000?

Definitions:

Cooperation

Working together with someone for mutual or reciprocal benefit.

Reciprocity

A social norm that involves mutual exchange of privileges, goods, services, or favors between individuals or groups.

Altruism

Selfless concern for the well-being of others, often leading to actions benefitting someone other than oneself.

Equity

The principle of fairness or justice in the way people are treated, including the distribution of resources or treatment based on needs and merits.

Q2: Calvin gave his son ABC stock valued

Q14: To which trial courts may a taxpayer

Q23: Cora, who is single, has $58,000 of

Q29: Windjammer Corporation, a cash-basis, calendar-year corporation sold

Q33: If a spouse accompanies an employee on

Q43: Tighe won a new automobile from his

Q60: A taxpayer who is a bona fide

Q67: Mid-month convention

Q72: Two married persons with moderately high incomes

Q105: The poverty rate is<br>A) The percentage of