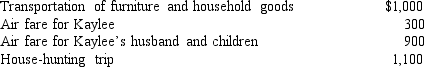

Kaylee is a member of the U.S. Armed Forces on active duty who moved because of a permanent change in station. She incurred the following moving expenses:  Kaylee's employer reimburses her $3,300 for the above expenses. Assuming that Kaylee meets all other requirements, how much income does Kaylee have as a result of this reimbursement of her moving expenses?

Kaylee's employer reimburses her $3,300 for the above expenses. Assuming that Kaylee meets all other requirements, how much income does Kaylee have as a result of this reimbursement of her moving expenses?

Definitions:

Cerebral Hemispheres

The two halves of the cerebrum.

Nerve Fibers

Long projections of nerve cells that transmit electrical impulses throughout the body.

Prefrontal Cortex

The front part of the frontal lobes of the brain, involved in decision making, problem-solving, and controlling social behavior.

Motor Cortex

A region of the cerebral cortex involved in planning, controlling, and executing voluntary movements.

Q7: A taxpayer can elect to expense immediately

Q28: YumYum Corporation (a calendar-year corporation) moved into

Q30: Carol wants to invest in a project

Q48: A tax textbook <br>f. Internal Revenue Code

Q53: The lease inclusion amount increases the deduction

Q56: Which of the following statements explain permanent

Q70: Poor nations typically have a competitive advantage

Q70: Which of the following is a tax?<br>A)

Q102: 13 Bonus depreciation and Section 179 expensing

Q108: Jerry and Matt decide to form a